Customer Owners,

Happy October to all! The colors of fall are in full swing, and as the leaves change and the days grow shorter, our thoughts are with you as you find ways of extending your grazing season, or fortifying your stockpiled forages. Just as the seasons change, so too do the challenges and opportunities of Southern Colorado agriculture.

Enhanced Security Measures

First and foremost, I want to address an essential matter. In recent times, we have noticed an increased number of spam, spoofed, and even fraudulent calls. Some of these impersonators have even posed as employees and team members. Their intent? To extract confidential information. Please be vigilant.

First and foremost, I want to address an essential matter. In recent times, we have noticed an increased number of spam, spoofed, and even fraudulent calls. Some of these impersonators have even posed as employees and team members. Their intent? To extract confidential information. Please be vigilant.

We safeguard your data and personal information not only with state-of-the-art security, but also with staff trained to adhere to strict security standards.

To combat this, we will be introducing enhanced security measures. In the near future, when you call Farm Credit, our representative might ask for additional security information. This is a necessary step to ensure the security of your data and our communications. Please be patient with us as we find the balance between security and convenience for you as members.

We take this matter seriously and thank you for your understanding and patience as we work to improve our protective measures.

The Cooperative Difference

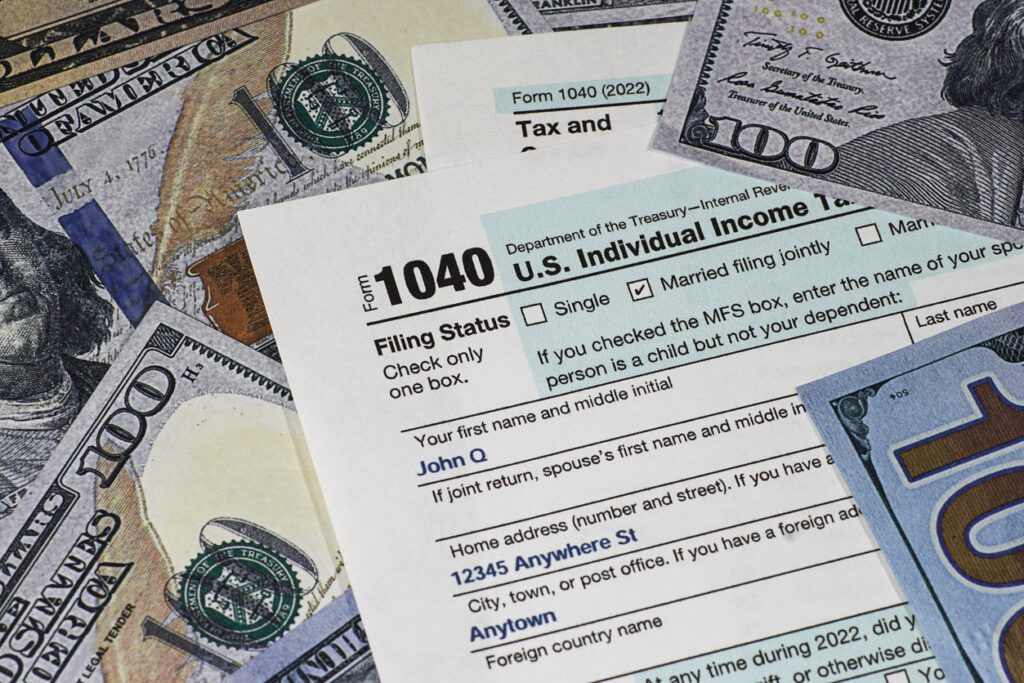

Last month I mentioned in my email that we had raised our Trust and Reserve Fund Rates. I also spoke to the large disparity between what local and national banks are paying for deposits versus their lending rates. I wanted to speak to another key difference between the Farm Credit System and banks. While we as Farm Credit are afforded a lower effective tax rate than our bank counterparts, I want to speak to the topic in terms of who truly benefits from this.

Last month I mentioned in my email that we had raised our Trust and Reserve Fund Rates. I also spoke to the large disparity between what local and national banks are paying for deposits versus their lending rates. I wanted to speak to another key difference between the Farm Credit System and banks. While we as Farm Credit are afforded a lower effective tax rate than our bank counterparts, I want to speak to the topic in terms of who truly benefits from this.

First, recall that in December 2017, Congress passed Public Law 115-97—commonly known as the Tax Cuts and Jobs Act (TCJA). Among many changes, TCJA lowered the top statutory corporate tax rate from 35 percent to 21 percent. I was just making the transition from banking to Farm Credit of Southern Colorado at that time. I recall many banks stating that those reduced taxes would lead to them paying employees more and to them increasing lending to customers at reduced lending rates. While lending did increase by banks as a whole in 2018, there is no data to support that employees of those banks received significantly higher wages or that rate offerings to customers were reduced as a result of this tax reduction. In the end, most of the retained higher net incomes of banks went to dividends and into the hands of a small group of shareholders.

Now, let’s contrast that tax position with Farm Credit and specifically Farm Credit of Southern Colorado. While Farm Credit is a Government Sponsored Enterprise (GSE) which is a specific type of financial institution created by the government to support specific sectors of the economy, this does afford the Farm Credit System and Farm Credit of Southern Colorado a lower effective tax rate than our banking competitors. What I feel is a key difference in the model worth pointing out though is that we are a Cooperative. We are owned and governed by our customers (all of you)! In addition, while we don’t pay as high of a corporate tax rate as a bank, what we do instead is return a larger portion of our earnings to our customer owners directly in the form of patronage. For example, last year, Farm Credit of Southern Colorado returned 41% of our Net Income to all of you. This is then money you have, to directly impact your family, your operation and your community. I still believe this is the most effective and efficient way to support rural America and agriculture. Our return of earnings via patronage versus a corporate tax which doesn’t get returned directly to you or our local economies is a huge advantage we all share in by doing business as a cooperative. I am grateful to have made my way to the Farm Credit System and I hope you continue to see the added benefits of being a part of our customer owned cooperative.

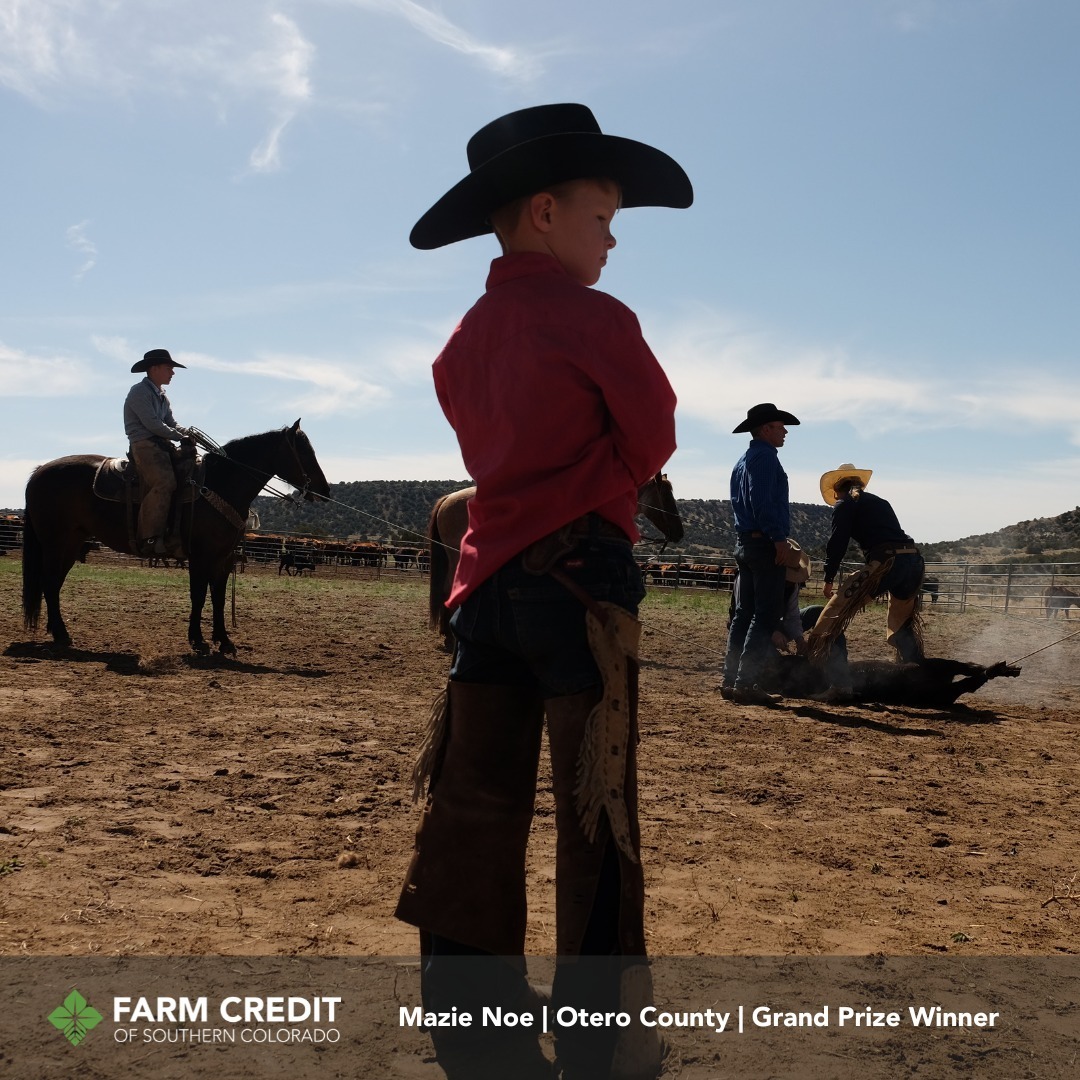

2024 Calendar Contest WINNERS!

I am thrilled to announce our 2024 Calendar Photo Contest Winners!

Grand Prize Winner: Mazie Noe of Otero County

2nd Place: Ashlee Smithburg of Lincoln County

3rd Place: Chase McHenry of Kit Carson County

If you’d like a copy of the 2024 Farm Credit of Southern Colorado Calendar for FREE, please pick them up at one of our office locations after November 1, 2023.

These wonderful images are a tribute to the spirit of our rural lives and we thank you for sharing the beauty you see every day.

As always, our doors and phones are open. Should you have any questions, concerns, or even just want to chat, feel free to reach out to any of our team members or to me directly. Here’s to a productive and safe October!

Sincerely,

Farm Credit of Southern Colorado CEO

Jeremy Anderson