We understand that starting a farm could appear stressful at first glance, especially if you are a young, beginning, or small (YBS) farmer. Applying for a farm loan can initially seem daunting, but understanding the process can make it much more manageable. That’s what we are here for! Our Farm Credit of Southern Colorado team takes pride in being a top-rated agriculture financial cooperative and striving to be a primary educational source for all farmers and ranchers nationwide.

If you are new to the industry or ready to take over your family business, starting with an ag loan in Colorado shouldn’t be an added stress. Let us walk you through the step-by-step loan application process for YBS farmers so you can confidently start today.

If you are new to the industry or ready to take over your family business, starting with an ag loan in Colorado shouldn’t be an added stress. Let us walk you through the step-by-step loan application process for YBS farmers so you can confidently start today.

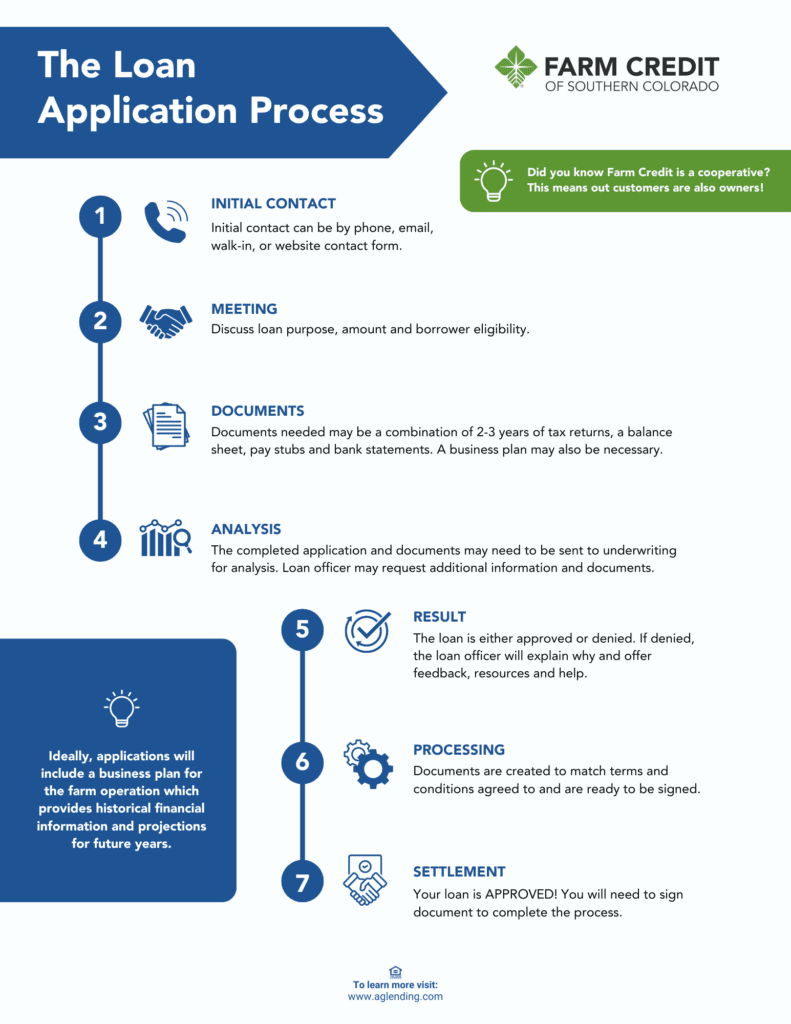

Here’s a simplified overview to guide you through each step of the farm loan application process:

- Preparation and Planning

Start by assessing your financial needs and goals. Determine the amount you need to borrow and its purpose: buy land, equipment, or cover operating expenses. Compile financial statements, tax returns, detailed business plans, and other necessary documents. This preparation will lay a solid foundation for your loan application.

- Initial Meeting

Schedule a meeting with your local Farm Credit of Southern Colorado office to discuss your needs. During this meeting, which can be in person or via telephone, a loan officer will review your plans and guide the types of loans available to you. This step is essential for understanding which methods suit your agricultural business. (And don’t worry, your FCSC loan officer will help you every step of the way after this meeting, so be open to asking any questions you may have.)

- Application Submission

Submit a valid loan application, including all the required documentation. This generally includes your business plan, financial records, and other pertinent information that proves your solvency or ability to repay the loan. The completeness and accuracy of your application can significantly impact the approval process.

- Credit Analysis

Your loan officer will next conduct a thorough credit check, examining your credit history, financial statements, and business plan. This step helps the lender assess your creditworthiness and the viability of your business. Providing clear and detailed information during this step can enable a smooth research process.

- Loan Decision

Once the credit is reviewed, the lender will decide on your loan application. This decision is based on your financial stability, credit history, and the strength of your business plan. You will receive a loan proposal outlining relevant terms and conditions if approved.

- Closing the Loan

Once you have approved the loan offer, you will enter the closing period. During closing, you will sign the necessary paperwork to finalize the terms of your new loan. Ensure you understand the contract before signing it, and never hesitate to ask your FCSC loan officer questions.

- Disbursement of Funds

After closing, the loan amount will be distributed according to the agreed terms. This money can then be used for your agricultural business in the manner specified in your loan agreement so you can begin your newly funded Colorado farm.

- Ongoing Management

Responsibly managing your loan, also known as debt at this point, is essential to maintaining a healthy relationship with your lender. Keep detailed records of your debts and payments and communicate regularly with your loan officer to address any changes or concerns.

By following these eight steps, you can confidently navigate the farm loan application process, ensuring you receive the financing needed to support and grow your farm business. This walk-through will help young, beginning, or small farmers across Colorado gain the confidence to take a step forward in your dream ag operation. Contact our loan officers at Farm Credit of Southern Colorado for more detailed information about starting a loan or anything else you may need assistance with. We are your partner in agriculture!