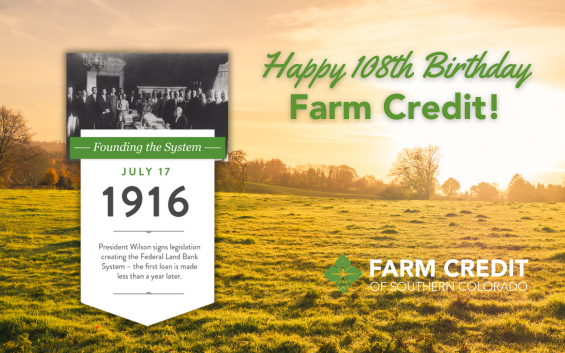

Did You Know? – Farm Credit turns 108 years old on July 17th, 2024!

Please help us wish our organization a very happy birthday!

It may seem wild, but Farm Credit has officially been around for 108 years and has affected many different people’s lives that whole lifespan. We are all quite familiar with what we know today about Farm Credit, but many may not know how FC got to where it currently is.

We’d love to highlight some significant events from Farm Credit’s history that have helped mold the whole Farm Credit ecosystem. From conception to legislation processes to nationwide growth and funding, their company history is fascinating and has events that may blow your mind! (We know the images from their timeline surprised us!)

So, here’s an informational timeline about Farm Credit’s Historical Journey to become the organization you know and love today:

1916: Establishment of the Federal Land Bank System

- The Federal Farm Credit Act was designed to create long-term farm loans, allowing them to purchase land and invest in agricultural enterprises. This marked the beginning of an economic assistance program dedicated to US agriculture.

-

1923: Agricultural Credits Act

-

- This Act expanded the system to include the Intermediate Credit System, offering short-term and medium-term loans to farmers for production needs such as seeds, equipment, and livestock, expanding the program to include intermediate credit facilities.

- This Act expanded the system to include the Intermediate Credit System, offering short-term and medium-term loans to farmers for production needs such as seeds, equipment, and livestock, expanding the program to include intermediate credit facilities.

1933: Farm Credit Act

- This Act was introduced during the Great Depression and restructured the Farm Credit System to provide more robust support for the ag community and prevent foreclosures, stabilizing the agricultural economy.

1971: Modernization and Expansion

- The Farm Credit Act of 1971 further modernized the system, expanding its services and strengthening its role in providing credit for all aspects of agricultural operations, including production, processing, and marketing.

1980s: Reforms During the Farm Crisis

- Significant reforms were enacted to stabilize the Farm Credit system in response to the severe farm crisis. This included the establishment of the Farm Credit System Assistance Board to provide financial aid and oversight on all processes.

1988: Toward Solvency and a New Structure

- The agricultural crisis of the 1980s was accompanied by changes in external factors that led to crop surpluses, rising interest rates and falling land prices. When the 1985 act failed to make the program available to distressed institutions, the 1987 Act eliminated the Federal Farm Credit Board and created a new Farm Credit Administration Board with enforcement powers.

1999: Restructuring for the Future

- After 1987, most members of the Cooperative Credit System consolidated into CoBank, while the Federal Land Bank Association transitioned to the direct-lending Federal Land Credit Association (FLCA) or merged with PCA as ACA. Through these efforts, the program was reduced from 404 lending institutions to only 185 when the parent ACA was enacted, increasing the cost savings and flexibility within the system.

2005: Return to Fully Borrower-Owned Status

- After a period of government support and oversight, Farm Credit returned to full ownership by borrowers, demonstrating its affordability and commitment to serving the farming community.

2016: Centennial Celebration

- Farm Credit celebrated 100 years of service just a couple of years ago, reaffirming its commitment to supporting US agriculture and rural communities, ensuring a more robust and brighter future for American farmers for years to come.

(*For more detailed information, visit the Farm Credit Timeline.)

The history of Farm Credit is exciting and vital to all Farm Credit Associations. It reflects a century-long commitment to supporting American agriculture through changing economic conditions, overcoming challenges, and pushing through adversity. Since its inception in 1916, through constitutional expansion, Trouble-era reform, and modern reforms, flexible farm loans have played an essential role in agricultural prosperity and emphasize enhancing development. We are thankful for the road that brought our cooperative to where it is today!

This blog post is for informational purposes only and should not be considered financial, legal, or investment advice. Any information contained in this post is subject to change without notice and should not be relied upon without seeking the advice of a qualified professional. The views and opinions expressed in this post are those of the author and do not necessarily reflect the official policy or position of our Association. The author and Association are not responsible for any errors or omissions and are not liable for any losses or damages arising from the use of the information contained in this post.